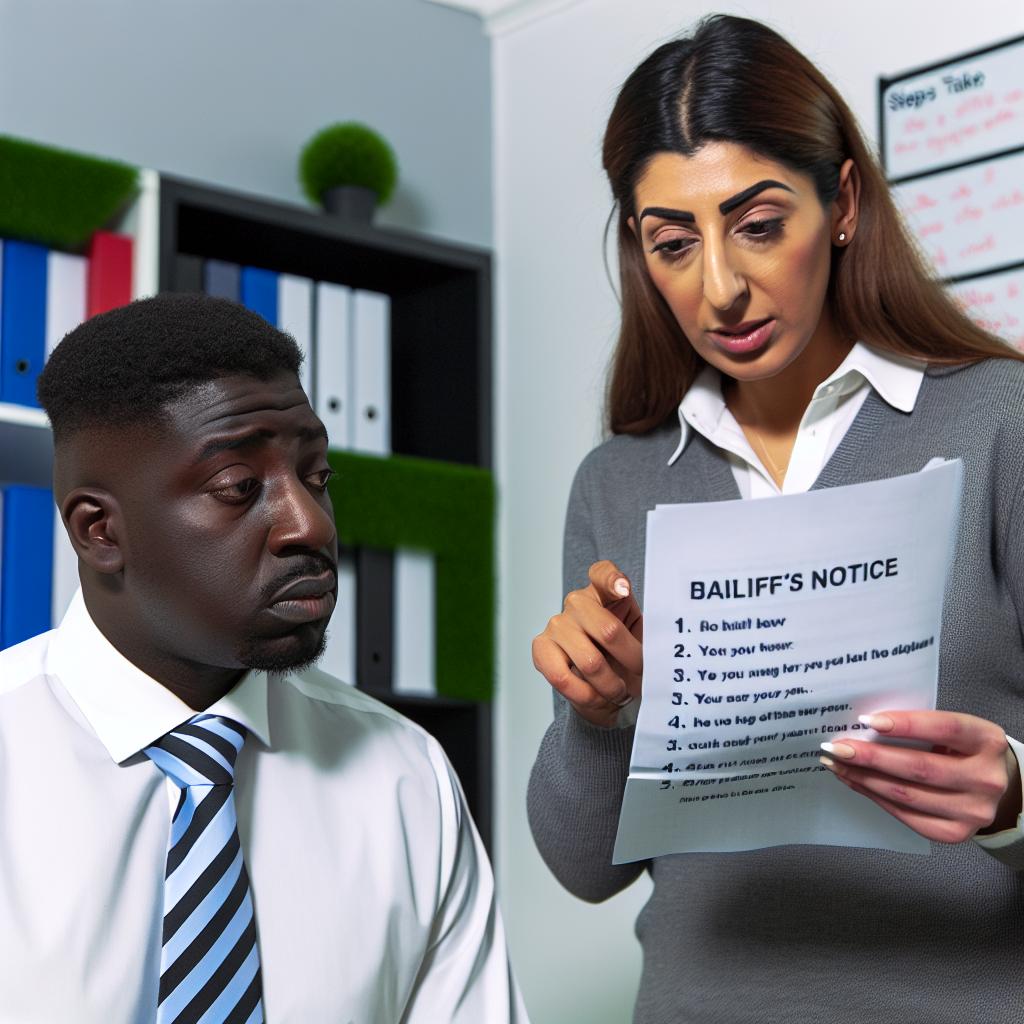

Steps to take if you receive a bailiff’s notice.

Understanding a Bailiff’s Notice

When you receive a bailiff’s notice, it is essential to understand what it signifies and how to manage the situation appropriately. A bailiff is an officer of the court who is authorized to enforce court orders, usually in relation to outstanding debts. The receipt of such a notice indicates that you have a debt or obligation which has progressed to the stage where enforcement actions can be taken. A thorough understanding of this process can facilitate effective handling and resolution.

Verify the Legitimacy of the Notice

Before taking any action, it is critical to confirm the legitimacy of the notice you’ve received. This involves a detailed review of the document to ensure it contains accurate personal details such as your name, address, the amount due, and a reference number for the court order. Furthermore, it is prudent to verify the credentials of the bailiff involved, ensuring they are properly registered. This verification can typically be done through the appropriate regulatory entity responsible for overseeing such matters. Ensuring the notice is legitimate is a foundational step in proceeding with any further actions.

Respond to the Notice

Upon confirming the authenticity of the notice, prompt response is necessary. Ignoring a bailiff’s notice can exacerbate the situation, often resulting in increased penalties or additional legal actions. If there are any inaccuracies or if you believe the notice has been issued in error, it is crucial to contact the issuer immediately to address and resolve any discrepancies. Prompt communication can sometimes prevent escalation and demonstrates your willingness to resolve the matter amicably.

Understand Your Rights

Understanding your rights in relation to bailiff actions is vital. Typically, bailiffs cannot force their way into your home; they are only permitted peaceful entry. Familiarizing yourself with these rights helps guard against unlawful actions and ensures you are prepared should a bailiff visit your premises. Additionally, it is important to know that bailiffs are restricted from seizing essential items necessary for day-to-day living, such as clothing, furniture, or fundamental household goods. This knowledge is critical in protecting your possessions and managing the situation effectively.

Seek Professional Advice

In situations where you are uncertain about the appropriate course of action, seeking professional advice is highly advisable. Legal advisors or debt counselors can provide tailored guidance that aligns with your specific circumstances. They can assist in elucidating your rights and options, thus empowering you to make informed decisions. Seeking expert advice often results in a more strategic approach to resolving the matter swiftly and efficiently.

Explore Payment Options

Once you have verified the validity of the bailiff’s notice, it is prudent to explore available payment options to resolve the outstanding debt. Reaching out to the creditor to discuss the viability of a payment plan or alternative arrangements can be beneficial. Demonstrating a willingness to address and resolve the debt is often viewed favorably and can sometimes prevent further enforcement action by the bailiff.

Document All Correspondence

Keeping meticulous records of all correspondence regarding the notice is crucial. This includes maintaining written communications, records of emails, and notes from any telephonic conversations. Thorough documentation serves as a critical resource should any disputes or misunderstandings arise in the future. Additionally, well-documented communications can provide a clear and consistent record of all interactions related to resolving the debt.

Prevent Future Incidents

To mitigate the risk of similar issues arising in the future, it is essential to proactively manage your financial responsibilities. Implementing organizational strategies such as setting up reminders for bill payments can be effective. Furthermore, consulting with a financial advisor may offer insights and strategies for better debt management, ensuring that financial obligations are met timely and effectively.

Takeaway

Managing a bailiff’s notice encompasses a sequence of informed actions, ranging from verifying the legitimacy of the notice and understanding one’s rights, to seeking professional advice and engaging directly with creditors. Prompt, informed actions can help in reducing the negative impact of a bailiff’s visit, providing a structured path to resolution.

For those seeking more detailed information on managing debts and interactions with bailiffs, resources offered by legal aid organizations or financial advisory entities can be invaluable. These resources can offer additional insights, tools, and support for addressing and resolving debt-related challenges comprehensively.

- Posted by

admin

admin - Posted in Uncategorized

May, 06, 2025

May, 06, 2025 Comments Off on Steps to take if you receive a bailiff’s notice.

Comments Off on Steps to take if you receive a bailiff’s notice.