The pros and cons of hiring a debt collection agency.

Introduction

When individuals or businesses fail to adhere to timely payments, creditors are often left considering the most effective method to recover outstanding debts. One potential solution is engaging a debt collection agency, an option that presents several advantages but also brings certain drawbacks. Comprehending the benefits and downsides of collaborating with a debt collection agency can equip businesses with the knowledge needed to make well-informed choices.

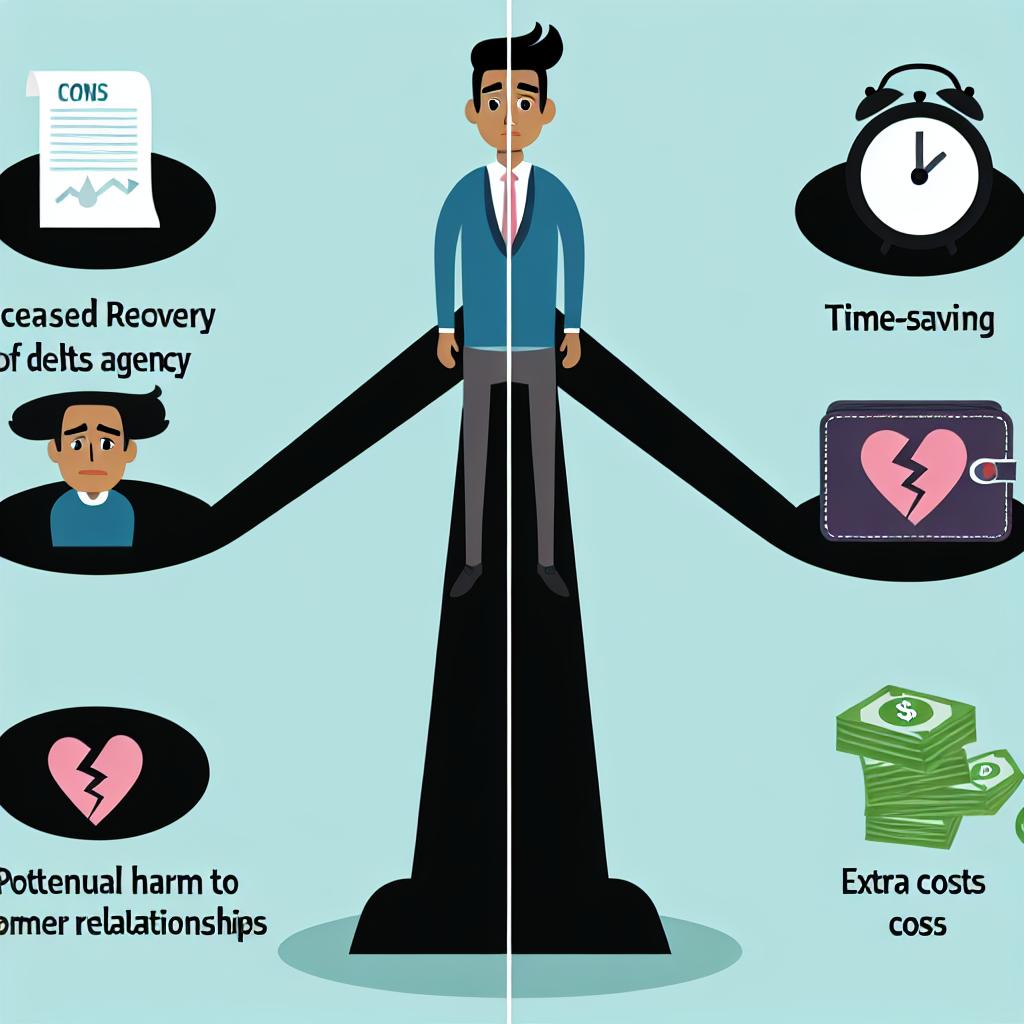

Pros of Hiring a Debt Collection Agency

Professional Expertise

Debt collection agencies are equipped with specialized knowledge and skills essential for efficient debt recovery. These agencies have a deep understanding of the legal frameworks surrounding debt collection, allowing them to navigate complex regulations with ease. Their extensive experience in dealing with different types of debt allows them to be more effective than internal resources at recovering payments.

Resource Allocation

Managing collections within an organization can be exceptionally resource-intensive and divert attention from core business activities. By outsourcing the debt collection task to a specialized agency, businesses can concentrate their internal resources on crucial aspects such as operations, marketing, and sales, while still pursuing overdue payments with the help of professional collectors.

Improved Recovery Rate

Debt collection agencies typically employ a variety of proven strategies and techniques geared toward recovering outstanding amounts. These targeted approaches often lead to higher recovery rates than what a business might achieve through internal methods. This improvement in recovery rates is particularly crucial for businesses dealing with a significant volume of outstanding debts.

Legal Protection

Navigating the legal intricacies of debt collection can pose a significant challenge. A reputable debt collection agency ensures adherence to all pertinent laws and regulations, thereby minimizing the risk of legal repercussions for the creditor. Compliance with legal guidelines helps protect businesses from potential lawsuits or penalties, thereby safeguarding their financial and legal interests.

Cons of Hiring a Debt Collection Agency

Cost Implications

Engaging the services of a debt collection agency entails incurring costs. Typically, agencies charge a fee, either as a percentage of the recovered amount or a flat rate, potentially affecting the net recovery for the business. Decision-makers must consider these costs in relation to the potential benefits achieved from elevated recovery rates.

Reputation Risks

One of the primary concerns when hiring a debt collection agency is the potential impact on the company’s reputation and customer relationships. Aggressive collection practices employed by some agencies may strain customer goodwill, potentially leading to negative reviews or loss of future business. To mitigate this risk, it is essential to select a reputable agency known for its customer-friendly approach.

Loss of Control

Outsourcing the debt collection process involves ceding some control over how debts are pursued. Businesses might have reduced visibility into the debt recovery process and could miss opportunities for direct communication with debtors. This reduced level of control may not align with the business’s preferred methods of managing overdue accounts.

Variable Effectiveness

The performance of different debt collection agencies can vary significantly based on factors such as their experience, strategies, and success rates. The effectiveness of an agency is not guaranteed and can fluctuate. Therefore, businesses must take care when choosing an agency, ensuring it aligns with their specific recovery goals to maximize their chances of success.

Conclusion

Hiring a debt collection agency offers a feasible solution for businesses aiming to recover overdue payments while allowing internal teams to focus on other essential priorities. Nonetheless, it is imperative to weigh the associated costs, potential risks to reputation, and the possible loss of control against the benefits before proceeding with a decision. Selecting the appropriate agency is crucial, as it can significantly affect the outcomes of debt recovery efforts. For those who are keen to delve deeper into the practices of debt collection, industry regulations, and related topics, numerous resources can provide further insights. By making well-informed decisions, businesses can protect their interests and ensure effective debt management.

- Posted by

admin

admin - Posted in Uncategorized

May, 27, 2025

May, 27, 2025 Comments Off on The pros and cons of hiring a debt collection agency.

Comments Off on The pros and cons of hiring a debt collection agency.