What is debt assignment, and how does it affect the debtor?

Understanding Debt Assignment

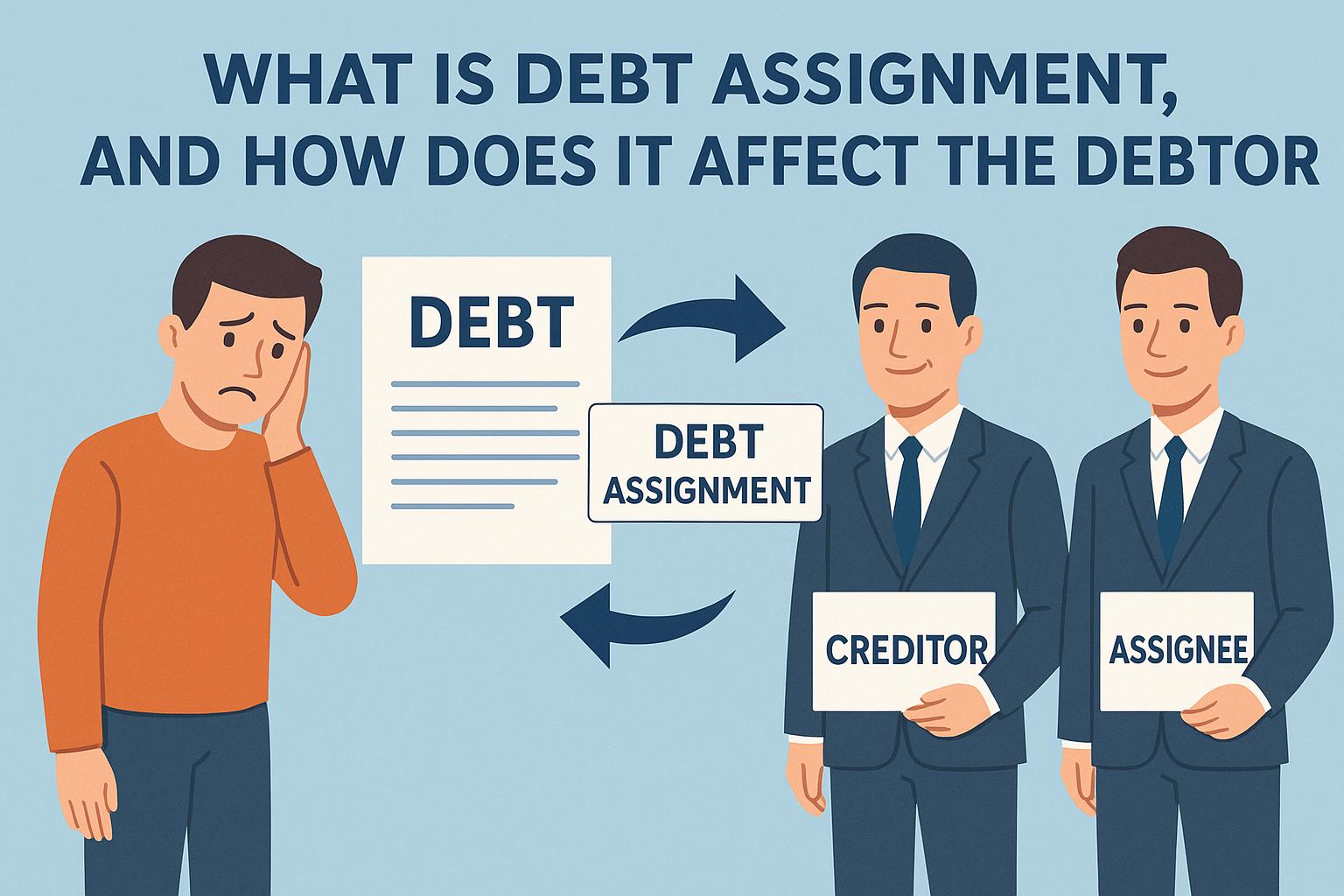

Debt assignment plays a critical role in modern financial management, enabling the transfer of debt obligations from one party to another. Understanding the intricacies of this process is vital for creditors, debtors, and the financial entities involved. The mechanism allows the original creditor, known as the assignor, to transfer the right to collect a debt to a third party, identified as the assignee. This transaction is typically motivated by objectives such as enhancing liquidity, releasing locked capital, or effectively managing financial risks.

Mechanics of Debt Assignment

Within the debt assignment framework, a legally binding agreement is established, laying out the conditions under which the debt is handed over from the assignor to the assignee. This agreement not only transfers rights but also responsibilities concerning the debtor. More often than not, debts are assigned to specialized entities like debt collection agencies or financial institutions with expertise in handling debt portfolios.

Legal Aspects

Legal considerations are central to the debt assignment process. The agreements must comply with prevailing laws and regulations, ensuring all parties are protected. While informing the debtor of the assignment is generally a prerequisite, specifics in the initial loan contract may outline additional conditions for the assignment. It is commonplace for certain contracts to include anti-assignment clauses, which restrict the transference of rights without obtaining prior approval. Navigating these legal intricacies requires a comprehensive understanding of both contractual obligations and relevant legal frameworks.

Involvement of Debt Collection Agencies

Debt collection agencies play a crucial role as assignees, handling the collection of debts on behalf of the original creditor. These agencies possess specialized skills in managing and recovering debts, which allows them to efficiently execute the collection process. Their involvement is particularly beneficial for creditors aiming to offload non-performing assets from their balance sheets, thus improving liquidity and reducing administrative burdens.

Consideration of Financial Regulations

Engaging in debt assignment necessitates adhering to financial regulations, which vary across jurisdictions. These regulations are designed to protect the interests of all parties involved, particularly the debtor. Compliance ensures that the rights of debtors are not compromised and that ethical standards are maintained throughout the assignment and collection process.

Effects on the Debtor

For debtors, the assignment of their debt leads to a change in the party to whom they owe the debt. However, their repayment obligations typically remain intact. It is essential for debtors to understand how this change affects their situation:

Notification of Assignment

The primary impact on the debtor is the receipt of a formal notification regarding the debt assignment. This communication should provide detailed information about the new creditor, alongside an affirmation of the debt’s transfer. Verification of this notice is crucial to prevent potential scams or misunderstandings. Debtors should remain cautious and verify the authenticity of the notice to protect their interests.

Change in Payment Details

With a new creditor in place, there’s often a shift in payment instructions or account details. Debtors are responsible for updating their payment records to reflect the new creditor’s information accurately. This step is crucial in avoiding penalties or missed payments that could arise from failing to honor the updated payment directives.

Verification and Continuity

To ensure a seamless transition, debtors should actively engage in verification processes, confirming the legitimacy of the new payment instructions. Maintaining payment continuity is essential and can prevent any disruptions that might lead to financial penalties.

Potential for Modified Terms

Despite the original debt agreement terms being upheld, assignees often introduce modified terms to improve repayment solutions. Potential modifications may encompass revised payment plans, altered interest rates, or settlement offers. Debtors who engage in proactive dialogue with the new creditor might uncover opportunities to negotiate terms that better suit their financial circumstances.

Negotiation Opportunities

Open communication with the new creditor can illuminate potential negotiation opportunities for debtors. By engaging in constructive discussions, debtors might be able to renegotiate terms that offer a more manageable approach to settling the debt.

Proactive Debt Management

Debtors who adopt a proactive stance in managing their debt assignment can potentially yield favorable outcomes by securing terms that are more aligned with their current financial capabilities and long-term goals.

Risk of Increased Collection Activity

Upon assignment, debts might end up managed by debt collectors or specialized agencies. These entities can sometimes employ more aggressive collection strategies compared to the original creditor. To protect their interests, debtors should familiarize themselves with their rights under laws like the Fair Debt Collection Practices Act (FDCPA) in the United States, which governs the conduct of debt collectors.

Conclusion

Understanding the institution of debt assignment is paramount for effectively navigating financial landscapes. This practice grants creditors enhanced flexibility in managing their debt portfolios, facilitating liquidity enhancement and risk mitigation. While debt assignment typically upholds the debtor’s fundamental obligations, it places crucial importance on clear communication with the new creditor. For debtors, staying informed and vigilant about changes in creditor dynamics and payment processes is essential, ensuring that they actively engage in negotiations to explore potential alternative arrangements that align with their financial goals. Through understanding the intricacies of debt assignment, all parties can work towards mutually beneficial outcomes.

- Posted by

admin

admin - Posted in Uncategorized

Sep, 04, 2025

Sep, 04, 2025 Comments Off on What is debt assignment, and how does it affect the debtor?

Comments Off on What is debt assignment, and how does it affect the debtor?