What is the difference between secured and unsecured debts?

Understanding Secured and Unsecured Debts

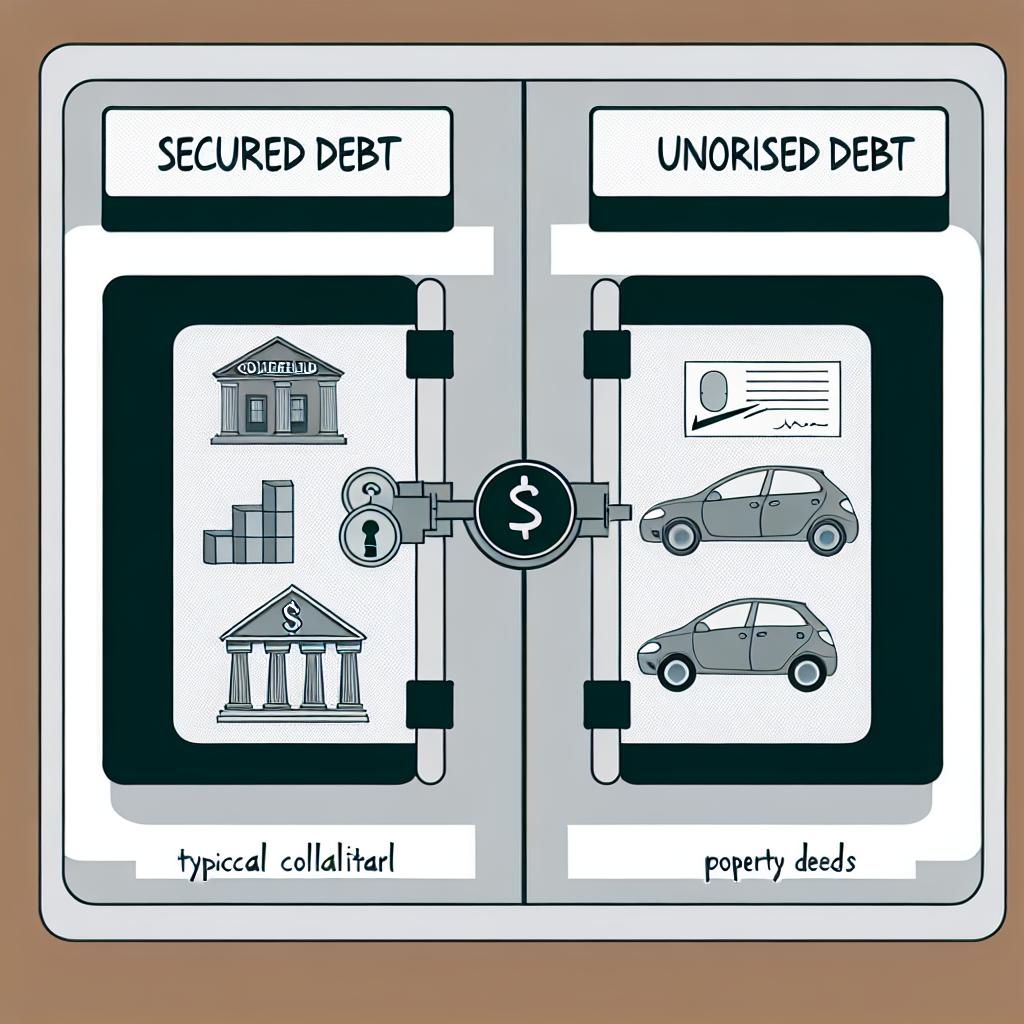

In the realm of personal and business finance, debts are categorized as either secured or unsecured. These terms primarily refer to whether or not collateral is attached to the debt, thereby influencing the level of risk for the lender and the borrower. Understanding the distinction between these types of debts can greatly impact financial planning and management.

Secured Debts

Secured debts are loans that are backed by an asset or collateral. This means that if the borrower defaults on the repayment, the lender has the right to seize the collateral to recover the owed amount.

Mortgages: These are loans used to purchase real estate, where the property itself serves as collateral. This means if payments are not made, the lender can foreclose on the property. Mortgages tend to have lower interest rates because the risk to the lender is minimized by the security of the property. Furthermore, borrowers often find that the interest on mortgage loans is tax-deductible, adding an incentive for opting for such debt when purchasing property.

Auto Loans: When a vehicle is purchased through financing, the car acts as collateral. Failure to make payments could result in repossession of the automobile. Because the vehicle itself secures these loans, lenders feel more at ease extending credit, often resulting in better financing terms for the borrower. Additionally, the importance of reliable transportation means that borrowers prioritize these payments, which can be beneficial for maintaining a good credit score.

The presence of collateral typically makes secured debts less risky for lenders, often allowing them to offer loans with lower interest rates compared to unsecured debts. Secured loans can provide borrowers with larger amounts of money, as the collateral offers substantial assurances to the lender. However, borrowers should be aware that the risk is primarily centered around the loss of the pledged asset if they default on the loan. It is crucial for borrowers to thoroughly assess their ability to repay such loans to protect their assets.

Unsecured Debts

Unsecured debts do not involve any specific assets as collateral. As such, if a borrower defaults, the lender cannot directly seize property as a form of repayment. Instead, lenders may need to pursue legal action or other avenues to collect the debt.

Credit Card Debts: Credit cards are typically unsecured, meaning that while non-payment can affect credit scores and result in collection actions, no specific asset is at risk of being seized directly. Despite the absence of collateral, these credit facilities offer significant convenience and flexibility to users. Cardholders can manage expenses and cash flow more effectively, making unsecured debt an attractive option for short-term financial needs. However, borrowers need to exercise discipline in managing their credit card usage to avoid accumulating unmanageable balances with high interest rates.

Personal Loans: These loans are often granted based on the borrower’s creditworthiness rather than collateral. Though some personal loans may be secured, the majority remain unsecured, meaning creditors rely heavily on the borrower’s credit score and financial history to mitigate risk. These loans can provide borrowers with crucial funds for various purposes, including home improvement and debt consolidation. However, they typically come with higher interest rates than secured loans, reflecting the increased risk to lenders in the absence of collateral. Potential borrowers should carefully assess their repayment capability before opting for such loans.

Secured debts generally have higher interest rates due to the increased risk for lenders. Additionally, lenders may impose stricter requirements for creditworthiness since they do not have collateral to fall back on. Borrowers must recognize that while they avoid risking assets as collateral, their credit scores become crucial in determining the terms and cost of credit.

The Impact on Borrowers

The choice between secured and unsecured debts significantly impacts a borrower’s strategy and risk. Borrowers with secured debts must be aware of the risk to their assets, while those with unsecured debts might focus on maintaining a good credit score to secure favorable terms. Understanding these differences allows borrowers to make informed, strategic decisions about their financial obligations, assessing both their current needs and their long-term financial goals.

Material possessions risk, interest rates, and ease of obtaining different types of loans all contribute to a carefully considered borrowing strategy. Borrowers must evaluate their individual circumstances, including their financial stability, future prospects, and goals, to determine which type of debt suits their situation best.

Factors to Consider

Whether opting for secured or unsecured debts, borrowers should consider several factors.

Interest Rates: Secured debts often feature lower interest rates due to reduced lender risk. However, unsecured debts might be more appealing despite higher rates if the borrower prioritizes not pledging any assets. When evaluating interest rates, borrowers should assess how the cost of servicing debt might affect their financial stability over time. Recent trends in interest rates can also influence the cost of borrowing and play a role in determining the right time to take on new debt.

Loan Terms: Examine the duration and conditions of the loan. Secured loans might offer more flexible terms due to the collateral involved. For example, longer repayment terms can spread out payments, making loans more affordable on a monthly basis. However, longer-term commitments often result in higher total interest paid over the life of the loan, so borrowers need to balance short-term affordability with long-term cost efficiency.

It is essential to understand these aspects thoroughly before making decisions about taking on debt. Borrowers are encouraged to seek professional financial advice and leverage online resources to enhance their understanding of the implications of secured and unsecured debts. For more information on managing debt, consider visiting reliable financial advice sites such as NerdWallet or consulting with a financial advisor.

Conclusion

In conclusion, recognizing the difference between secured and unsecured debts is vital for managing financial health effectively. The choice between these two types of debt often depends on personal circumstances and financial goals. However, an informed approach helps mitigate risks and optimize financial planning. By carefully considering their options, borrowers can align their debt strategies with their overall financial objectives, ensuring prudent management of their financial resources while navigating the complexities of borrowing.

- Posted by

admin

admin - Posted in Uncategorized

Jun, 10, 2025

Jun, 10, 2025 Comments Off on What is the difference between secured and unsecured debts?

Comments Off on What is the difference between secured and unsecured debts?